Mark up rate calculator

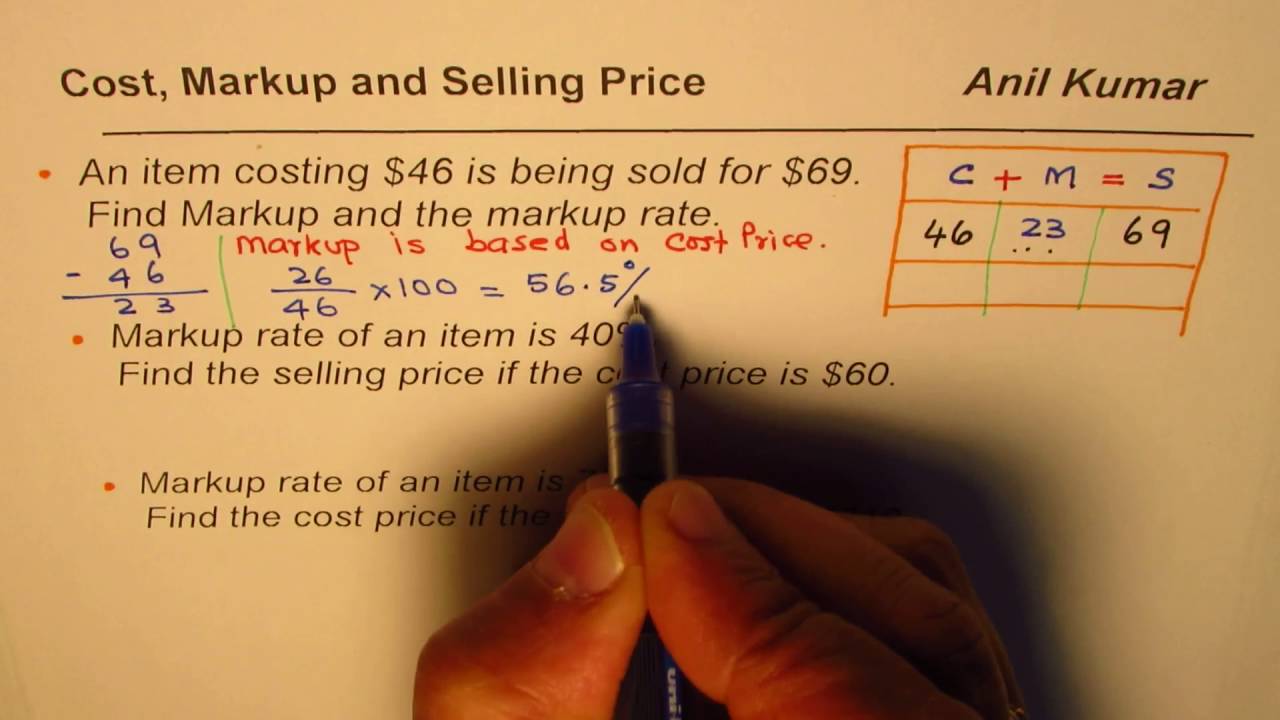

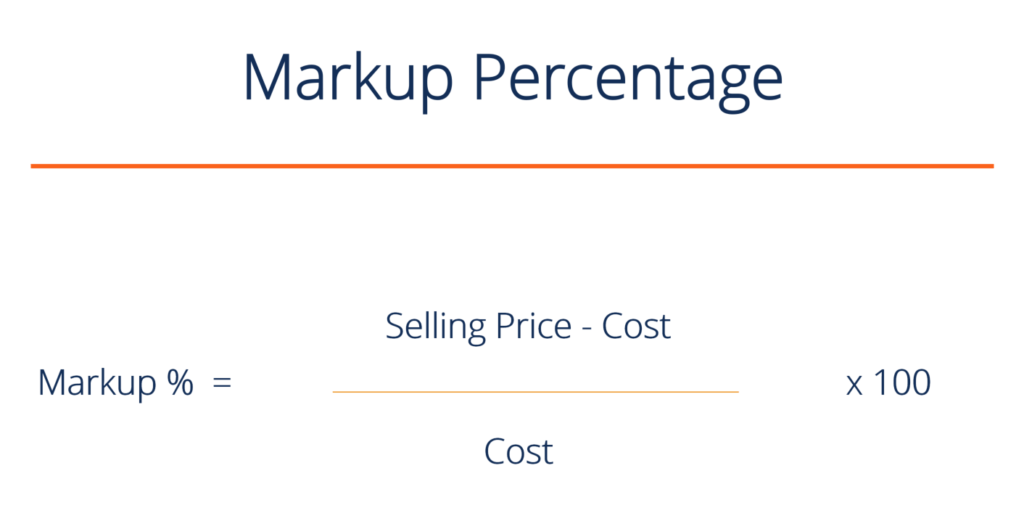

To calculate markup as a percentage you must divide Profit by Purchase Price and multiply the result by 100. In this case your markup is the same as your profit.

How To Calculate Markup In Excel Techwalla

Markup Calculator is a tool that helps you to calculate the desired average markup price for your product or service.

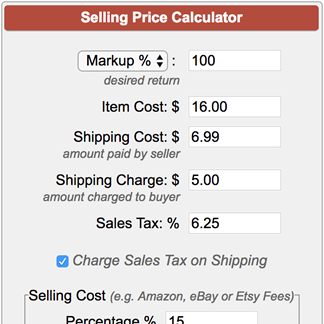

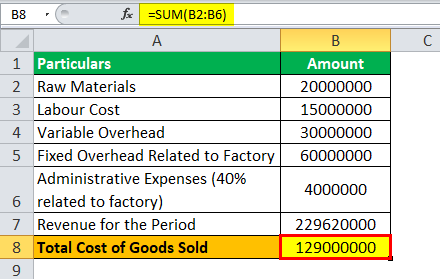

. Simply add the cost of goods to the result of multiplying the cost of goods services by the markup rate. Example of a calculation Assuming that the original cost of a product was 1000 and a gross. Markup calculator - used in managerial or cost accounting markup formula is the difference between the selling price and cost divided by cost.

If you need the selling price This is probably the most common. In other words if my total employee burden cost is 26 hr would it look like 26 hr x 4 hrs 104 x 15 markup. Mark-Up refers to how much money you add onto the product from your purchase price.

Understanding the markup Markup The percentage of profits derived over the cost price of the product sold is known as markup. The Net Amount before sales. And try revenue cost cost markup 100.

This is a percentage of the cost that should be added to the cost to establish a selling price. Unlike profit margin which is constrained between 0 and 100 a markup can go above. For example if a product sells for 125 and costs 100 the additional.

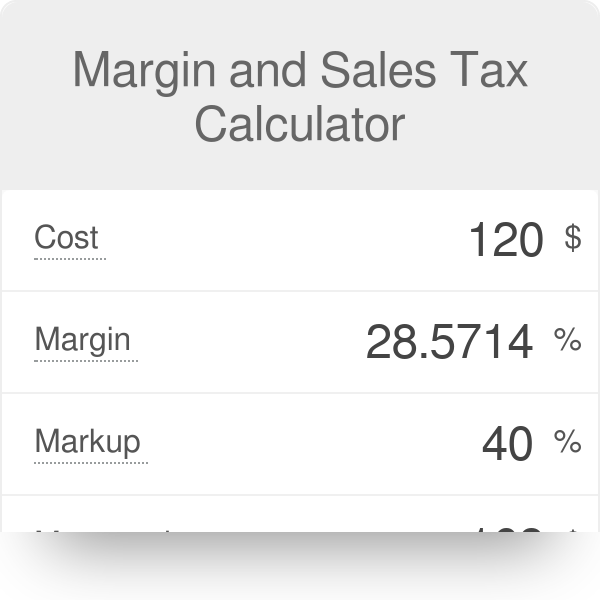

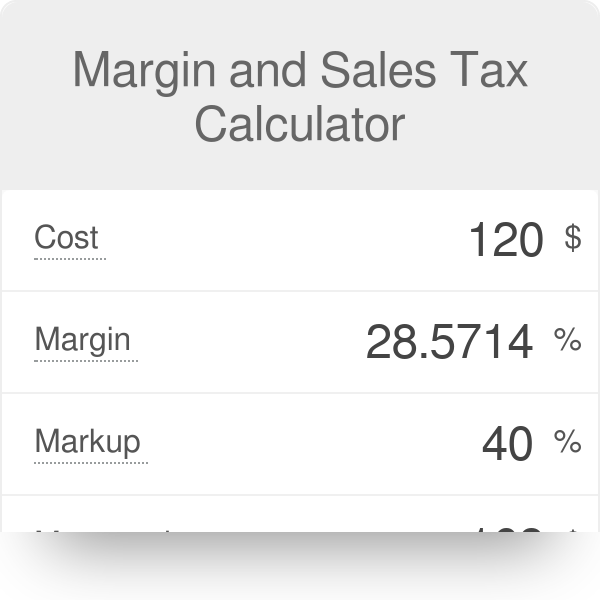

Margin and Markup Calculator. Enter the sales tax rate into the Markup Percentage say 7. Maximize your parts profits.

Pricing Approach does not take into account factors like change in. Or using the same 26 hr rate would you use the standard here of 30 40 hr x. Use our free parts markup calculator to determine your ideal gross profit markup percentage for your heavy-duty repair shop.

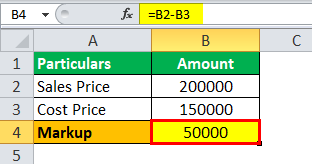

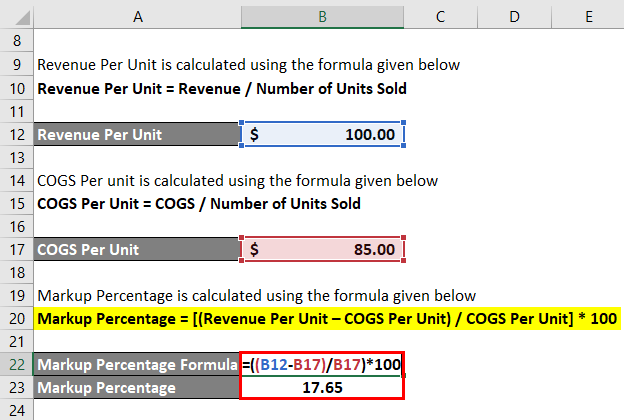

Lets take the example. You can download this Markup Formula Excel Template here Markup Formula Excel Template Example 1 If a product is sold for 200 per unit and the cost per unit of production is 130. So the formula of markup becomes.

For example with a rate of 40 and a cost of 100 the markup price is simply. Markup 100 revenue cost cost. Selling price revenue is obtained by dividing the original cost by 1 Gross margin rate.

To determine his markup percentage he uses the formula. To help you keep track of gross margin and profitability here is a simplified formula that you can use to assess whether your bill rate is set at an appropriate amount. He includes 75 as his selling price.

Mark-Up is a method commonly used to determine what price a Retailer should sell at. Markup percentage selling price - cost cost x 100 Abram inputs his numbers. Set the other three inputs Net Amount Amount and Discount Percentage to 00.

It is determined by dividing the. Or given as a percentage the markup percentage is 429 percent calculated as the markup amount divided by the product cost calculated as the markup amount divided by the. Markup is the difference between a products selling price and cost as a percentage of the cost.

How To Calculate Markup Selling Price And Markup Rate Youtube

Markup Calculator Formula And Margin Comparison Excel Template

Selling Price Calculator

Margin And Sales Tax Calculator

Markup Calculator Ray Sanchez

Use This Markup Calculator Reporting Example

Markup Percentage Definition Formula How To Calculate

Markup Percentage Definition Formula How To Calculate

Margin Calculator

Sales Tax Calculator

Markup Calculator Calculate The Markup Formula Examples

Markup Formula How To Calculate Markup Step By Step

What Is Margin Markup Vs Margin Definition Calculator Formula More

Markup Posted By Michelle Cunningham

Markup Percentage Formula Calculator Excel Template

Pricing For Profitability An In Depth Guide To Markups And Margins Yoprint

Markup Percentage Definition Formula How To Calculate